Client Services

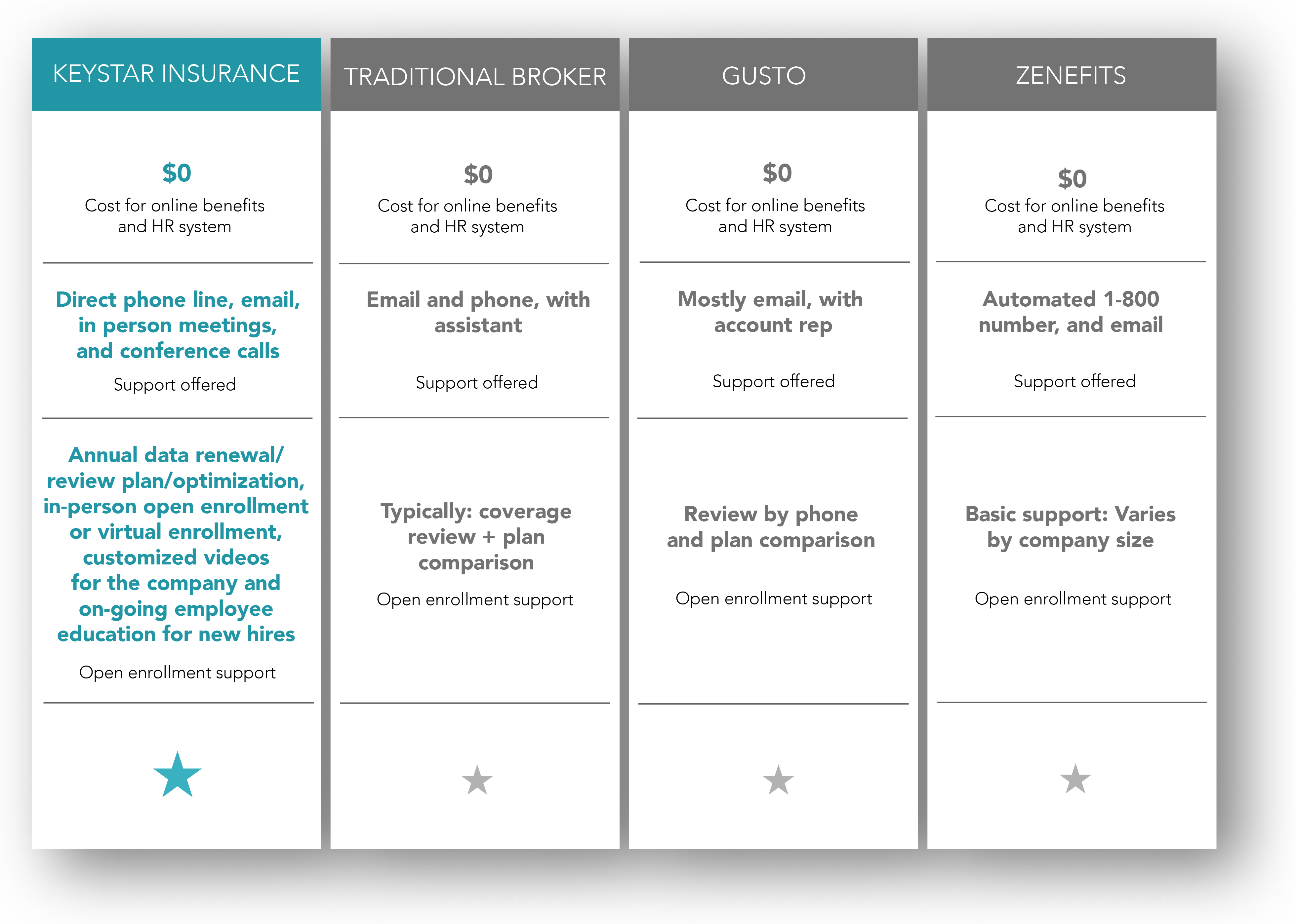

At KeyStar Insurance Services, we provide a single point of contact for you to reach out to. We help clients with a wide range of service issues, including billing, claims, and eligibility communications. The overall success of your business is our first concern, not just selling you a plan. We provide communication materials and in-person bilingual open enrollment meetings.

We have access to thousands of resources to help your business. We can support your HR department with resources from employee handbooks, compensation statements, recruiting strategies, newsletters, and benefit summaries. We provide all of our clients with a customized portal to access thousands of documents on demand.

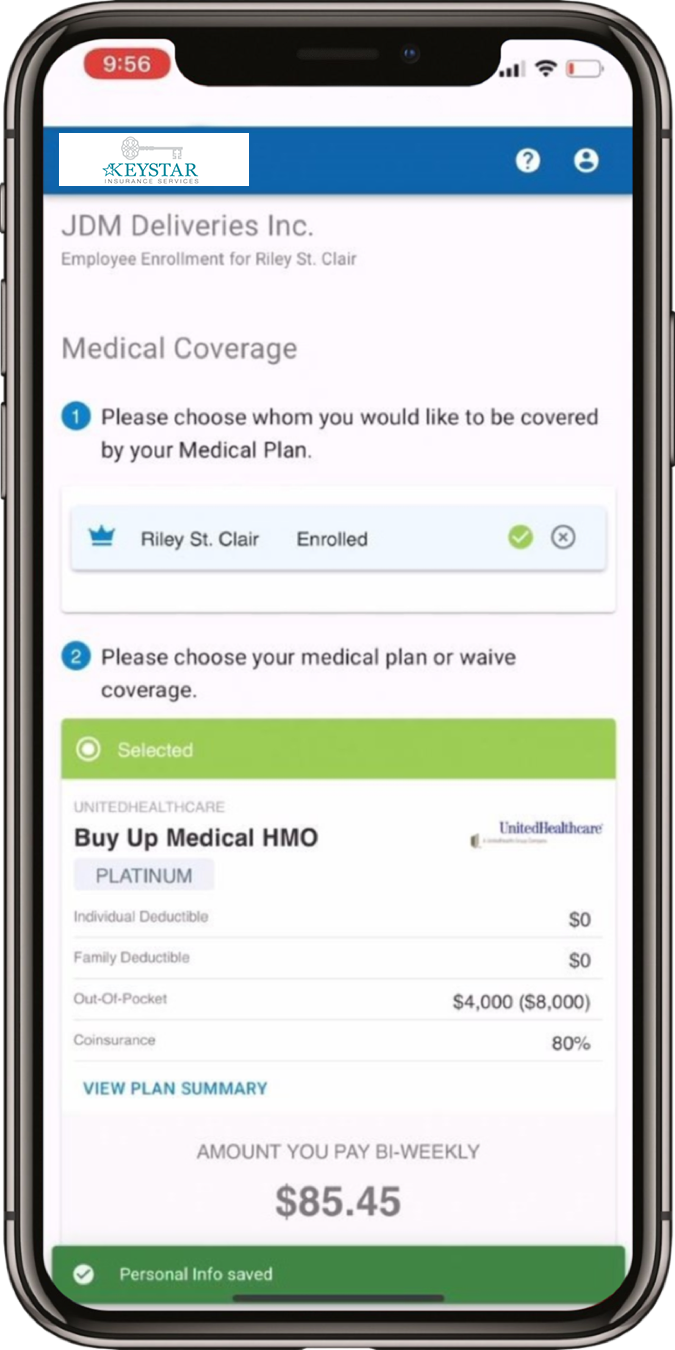

- HR Benefit Administration Portal

- On-the-Go Medical Health Insurance Enrollment Platform

- Online Enrollment to the list of technology available in your pocket

- Quick & Easy set up

- Large Group/Small Group

- Increase in voluntary participation

- Telemedicine

- Teledoc

Extensions of Key Star Insurance:

- Access to law attorney’s workers compensations

- Financial Advisors

- CPA’S

- HR Consultants / Payroll Services

- Bookkeepers

HR Solutions

KeyStar Insurance Services offers our clients extensive HR support and valuable resources to help shift liability and solve human resources issues before they arrive. Our clients receive access to an online portal designed specifically to help business owners, decision makers, and human resource administrators. This provides crucial information on best practices in HR, legal compliance, employee issues and policy management. In additional to the web-based portal, we work with HR consultants and attorneys.

COBRA Administration

COBRA can be an added burden to any employer and takes up valuable time and resources. With healthcare reform upon us, and additional regulations being handed down to employers, our COBRA third party administrators keep our employer groups in compliance. Talk to your KeyStar Insurance broker today about this crucial value added service.

COBRA services include:

- Initial rights notices sent to eligible employees

- Tracking, maintaining, and reporting activities for audit support

- Access to account history, including current participant detail in real time

- Online resource center – review federal guidelines, the latest IRS rulings, and recent court decisions

- Prepare and distribute open enrollment rate and carrier change communication to participants

- Bilingual customer support to participants

- Online reporting

COBRA qualifying events:

- Termination – for reasons other than gross misconduct

- Reduction in hours

- Divorce or separation

- Covered employee moving to Medicare

- Loss of dependent child status

- Death of employee

- Loss of other group coverage

- Loss of Medicaid (MediCAL)

Compliance

We understand that staying in compliance with the constantly changing regulatory landscape is a monumental task. Our experienced team is here to identify risks and offer compliance solutions that align with your business needs.

We help clients understand the risks, navigate the changes and explore potential opportunities in the Patient Protection and Affordable Care Act (ACA). Employers must understand not only the formal elements of reform but anticipate the unintended consequences and potential market shifts in the delivery of healthcare as providers and payers seek to reinvent themselves in a new system governed by changes in regulation and reimbursement.