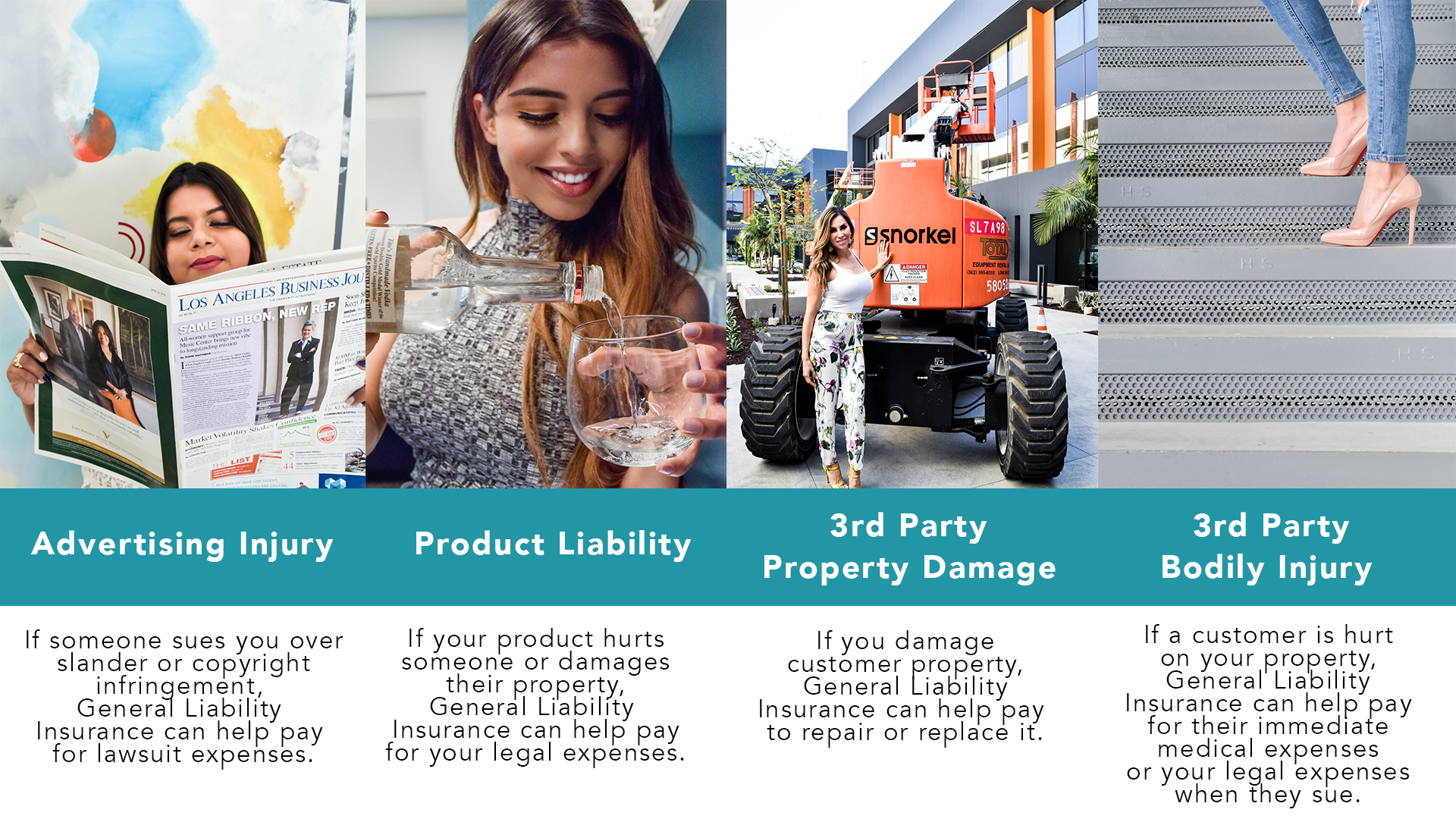

A General Liability policy can help pay for lawsuits over:

- Third-party bodily injuries.

- Third-party property damage.

- Product liability.

- Advertising injuries.

If customers, clients, vendors, subcontractors, or other non-employees sue you over the reasons listed above, the insurance company can cover the cost of the lawsuit, paying for:

- Legal teams to represent your small business.

- Witness fees.

- Evidence costs.

- The judgment or settlement (the final amount of damages you owe the other side).

General Liability Insurance is an essential safety net when you don’t have deep pockets because it can provide funding when things go wrong.

– Jade Dasaa, J. Bee Boutique

Small Business Lawsuit Examples

Property Damage Lawsuit

Read Scenario

Personal Injury Lawsuit

Read Scenario

For example, you are a hotel owner. One particular guest has stayed at your establishment for four nights. They have been rowdy, and there have been complaints from other guests about the noise level. You assume that their past behavior makes it likely that they will try to leave without paying. So, on the day of their checkout, you have your security staff prevent them from leaving through the front door. You try to hold them in the hotel until they agree to pay for the four-night stay. The hotel guest can file a lawsuit against your hotel company for keeping them against their will. As part of the personal injury component of your general liability insurance, you will be protected against having to pay for all of your legal fees out of pocket.

Bodily Injury Lawsuit

Read Scenario

For example, you run a day spa that offers clients a wide variety of services, including hair styling, massages, makeovers, waxing, and laser treatments. On one occasion, a customer requested a laser hair-removal treatment. You bring them back to the room that has the proper equipment and tell them to have a seat. As the customer makes their way across the room to sit down, they trip over the cord for the hair-removal machine. Their fall results in several broken bones. In their lawsuit, they request reimbursement for their medical bills, their pain and suffering, and lost wages from having to miss several weeks at their job. Thankfully, a general liability policy will help to pay for each of these costs.

Advertising Injury Lawsuit

Read Scenario

For example, you run a nail salon. You have several competitors in the area and are worried about losing potential clients to the other salons. So, you decide to run an advertisement in the Sunday paper. In the ad, you mention two of the other nail salons. You claim that your company’s services are superior because, unlike the competitors, your salon is clean, inviting, and creates stylish nail designs. Your competitors could file a lawsuit for libel, which means that they claim your ad damages their reputation. The personal and advertising injury protection within your general liability insurance will help to cover the legal costs.

Property Damage Lawsuit

Read Scenario

Personal Injury Lawsuit

Read Scenario

For example, you are a hotel owner. One particular guest has stayed at your establishment for four nights. They have been rowdy, and there have been complaints from other guests about the noise level. You assume that their past behavior makes it likely that they will try to leave without paying. So, on the day of their checkout, you have your security staff prevent them from leaving through the front door. You try to hold them in the hotel until they agree to pay for the four-night stay. The hotel guest can file a lawsuit against your hotel company for keeping them against their will. As part of the personal injury component of your general liability insurance, you will be protected against having to pay for all of your legal fees out of pocket.

Bodily Injury Lawsuit

Read Scenario

For example, you run a day spa that offers clients a wide variety of services, including hair styling, massages, makeovers, waxing, and laser treatments. On one occasion, a customer requested a laser hair-removal treatment. You bring them back to the room that has the proper equipment and tell them to have a seat. As the customer makes their way across the room to sit down, they trip over the cord for the hair-removal machine. Their fall results in several broken bones. In their lawsuit, they request reimbursement for their medical bills, their pain and suffering, and lost wages from having to miss several weeks at their job. Thankfully, a general liability policy will help to pay for each of these costs.

Advertising Injury Lawsuit

Read Scenario

For example, you run a nail salon. You have several competitors in the area and are worried about losing potential clients to the other salons. So, you decide to run an advertisement in the Sunday paper. In the ad, you mention two of the other nail salons. You claim that your company’s services are superior because, unlike the competitors, your salon is clean, inviting, and creates stylish nail designs. Your competitors could file a lawsuit for libel, which means that they claim your ad damages their reputation. The personal and advertising injury protection within your general liability insurance will help to cover the legal costs.

4 Ways General Liability Insurance Protects Your Business

Third-Party Bodily Injury

Third-Party Property Damage

Product Liability

Advertising Injury

Pages